Investment Corner with Kleinwort Hambros

FIXED INCOME

Summer doldrums

The summer season has been rather quiet for bond markets so far, with interest rates and corporate bond spreads moving in narrow ranges. Given the extremely low-yield environment we are re-assessing the defensive characteristics of our government bond exposure and taking some profits.

Summer is not always a quiet time in financial markets. The summer months of 2007, 2011 and 2015 saw investors glued to their screens instead of relaxing on the beach as important events unfolded during the holiday season. This year, with a pandemic spreading across the globe and so many unknowns regarding its development, the ingredients were in place to keep tensions high. Nevertheless, summer has proved rather calm for both government and corporate bonds, but of course this is no guarantee for a quiet autumn.

Sovereigns

US. After new lows at the beginning of August, 10-year yields have moved higher and are now back to 0.68%, around their average between April and July and still definitely close to all-time lows. With an abundance of Treasury auctions in early September and the potential for additional offers needed to fund a stimulus deal later this month, only a surge in inflation could provide upward-pressure in the short term. We do not expect this given large output gaps and very low money volatility.

UK. Recent discussions at the Bank of England suggest negative interest rates are not on the agenda and that asset purchases and forward guidance will remain the preferred tools. Meanwhile, investors weighing the increased risks of a no-deal Brexit, as well as growing anxiety among UK businesses regarding the end of the furlough scheme in October provide pressure on yields.

Given the extremely low-yield environment, the traditional benefits of downside-protection and income generation is greatly diminished. This encourages us to take profits and reduce our exposure.

Eurozone. The new €750bn joint stimulus plan approved by European governments will see the EU become an important issuer in the euro bond market. Given its high issuer rating, this will significantly increase the pool of "safe" bonds available to investors. The plan will also reduce funding-needs for individual countries, easing upward yield pressure on weaker issuers. Moreover, ECB asset purchase programmes remain in place. This will help keep yields low for both core and peripheral countries.

Credit

US. Yield differentials ("spreads") for both IG and High Yield (HY) bonds have traded in a narrow range in August. IG issuance has been very high this year but easily absorbed by markets - deals were well oversubscribed with only small yield concessions. Going forward, we expect less issuance: first, the need for funding will decline gradually; second, companies will at some point begin to think about repairing their balance sheets by reducing their debt levels. However, it is unclear if this shift is imminent - although fundamentals are under stress, markets remain supported by strong demand and abundant liquidity.

UK. IG spreads tightened slightly in August, shrugging off lingering concerns about the immediate economic outfall of the COVID pandemic, especially due to substantial support from abundant liquidity in the sterling market. Absolute yield levels remain at historic lows but the asset class offers a compelling yield pick-up over sovereigns. We expand our existing positions but remain Underweight.

Eurozone. Spreads fell marginally in August for both IG and HY bonds. But while second quarter earnings surprised on the upside, they were still the worst on record. However, investor demand remains strong and liquidity is plentiful thanks to generous central bank purchase programmes providing strong support to credit markets.

Emerging Market (EM) debt

Abundant liquidity and low US rates have caused EM debt spreads to narrow considerably from this year's pandemic-induced highs. While the yield on offer is compelling, we no long feel it warrants the credit risk that EM issuers carry, particularly those issuers whose fiscal health is heavily influenced by the price of oil, which we expect to remain subdued. We exit our modest positions and downgrade to Underweight.

Past performance should not be seen as an indication of future performance. Investments may be subject to market fluctuations, and the price and value of investments and the income derived from them can go down as well as up. Your capital may be at risk and you may not get back the amount you invest.

EQUITIES

Back to black

Global equity markets have received ample support from monetary and fiscal policy since the pandemic struck, enabling global indices to recover dramatically and register positive performance for the year so far. Amidst a tentatively recovering economy and continuously buoyant momentum we are adding to equities, thereby narrowing our underweight stance.

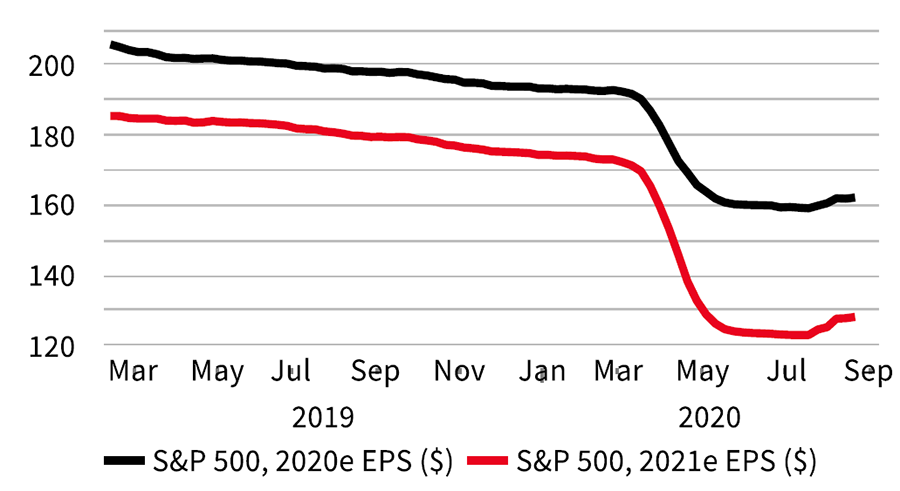

US. The second-quarter earnings season provided a series of positive surprises, with earnings-per-share (EPS) beating expectations by 20% taking the S&P500 to new all-time highs. However, the scale of the surprises simply reflects very low expectations - EPS for Q2 actually declined 33% YoY. Moreover, as illustrated in the chart, consensus expectations for 2021 EPS remain below pre-crisis forecasts for this year.

Despite the recent sell-off - particularly amongst ultra-high valued tech stocks - the forward price-to-earnings ratio (PER) remains at the highest since the tech bubble in 2000-2002. This is partly justified by an unprecedented level of money supply weighing on interest rates, partly by the continuously strong growth fundamentals of large-cap companies throughout the pandemic. We adjust our position in line with drift and remain Overweight.

UK. With the UK registering larger numbers of COVID-19 deaths than its neighbours and the future trade relationship with the EU still unresolved, UK equities have continued to underperform global averages. Recording the deepest recession reported by any European or North American country in Q2, as well as experiencing growing anxiety about the forthcoming end of fiscal stimulus such as the government-sponsored furlough program, UK equity prices remain under significant pressure. However, this has left the market looking cheap on measures such as price to cyclically-adjusted earnings (CAPE) and price to book value (P/B). This justifies a Neutral allocation in our view.

Eurozone. Like their US counterparts, eurozone stocks outperformed EPS expectations for Q2 with earnings coming in 24% above forecasts. The consensus now expects EPS to fall 37.3% in 2020 compared to last year, followed by a 51.1% rebound in 2021. Much will depend on how businesses recover from this year's disruptions, which should be supported by the bloc's recently agreed €750bn joint stimulus package. Finally, despite a number of regional flare-ups of COVID-19 infections, new nationwide lockdowns impeding economic activity remain unlikely. We remain Neutral.

Japan. Tokyo is another defensive market which has outperformed this year. The government's stimulus programme is the largest among developed economies as a percentage of GDP, which should help mitigate the impact of restrictions on the economy. The International Monetary Fund expects a -5.8% decline in GDP this year compared to -8.0% on average for advanced economies and the procyclical nature of the market should be helped by a nascent global economic recovery. The safe-haven characteristics of the underlying Yen-exposure round off the defensive positioning. We upgrade our position to Overweight.

Emerging Markets. After many years of underperformance, emerging market equities have almost kept pace with developed markets so far this year and broke into positive territory only days after the MSCI World in early August. This performance has been greatly aided by China, the largest emerging equity market, which has gained 17.1% so far this year. The pandemic situation and economic environment in other regions however remains shaky - we remain Underweight.

EPS expectations remain below pre-crisis levels

Past performance should not be seen as an indication of future performance. Investments may be subject to market fluctuations, and the price and value of investments and the income derived from them can go down as well as up. Your capital may be at risk and you may not get back the amount you invest.

CURRENCIES

Dollars and sense

The US dollar is still unloved, and with rates to stay low for a very long time, this may just be the start. That said, valuations in most of the major currencies versus the US dollar are stretched in the short term.

Dollar Index. The dollar is desperately trying to recover, but it simply doesn't have the backing. With the yield advantage diminished, unprecedented monetary stimulus, pending US elections, and rising equity markets, this is not a bullish environment for the greenback. That said, the $ is due a correction, and appears oversold in the short term. As for a catalyst, an equity market correction could be what is needed. In August the Dollar Index (DXY) hasn't been able to break and hold above 93.00, and this is just the first hurdle. The Federal Reserve recently stated that they would be happy for inflation to run above 2%. Of course in reality, it will be difficult to get inflation moving, and rates are expected to stay super low for a very long time. We expect the US dollar to re-group soon, but the longer turn picture is not one conducive to USD strength.

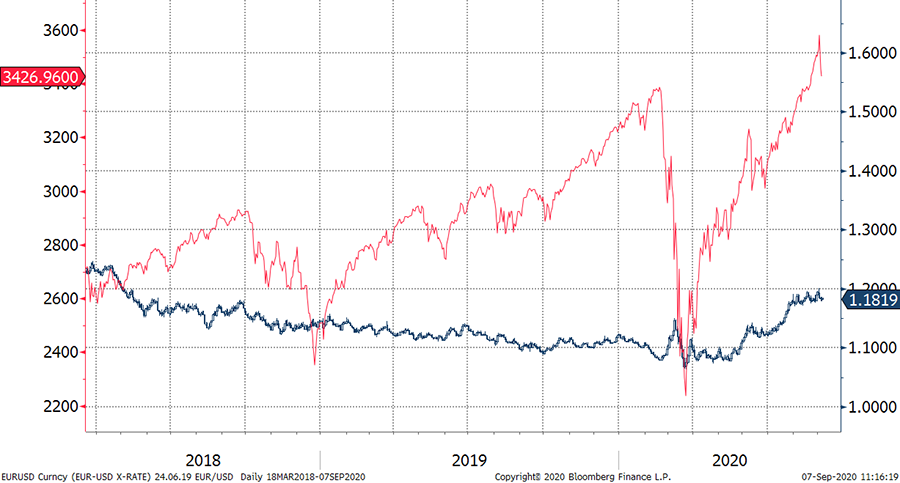

EUR/USD. The US yield differential has disappeared, and the Federal Reserve has essentially told markets that rates aren't going anywhere for a very long time. The frothy equity markets have kept on going, propelled less by fundamentals, and more by central banks. This has boosted EUR/USD, which struck 1.2000 in August. The positive correlation between US equities and the euro has continued. European Central Bank (ECB) members recently commented on the strength of the euro; this is unlikely to knock EUR/USD of its block, but it may be the start of further comments from the ECB. Overall, the single currency is overstretched, and in the weeks ahead we anticipate a slowdown in EUR/USD. For the fourth quarter we are sticking to our 1.1700 forecast.

GBP/USD. After failing to break below 1.3000 in the middle of January, GBP/USD shot up to almost 1.3500, the highest level in two years. Until recently sterling had been shrugging off Brexit risks, very weak growth data, and the harsh economic reality. Although, we are seeing signs that this is changing, considering the hardline talk from both sides. The weaker dollar is still driving FX markets, and even though we expect more dollar weakness to come through over time, the recent move to the topside seems overdone in our view. For the last quarter of 2020 we are keeping our forecast unchanged at 1.3000.

USD/JPY. Since April, USD/JPY has traded within a 5.5% range between 104 and 110. Volatility has been low, compared with safe haven assets such as Gold. Considering, the US dollar weakness it is surprising that USD/JPY isn't lower than current level 106.25. The Yen is providing some stability though, and if we see a market correction in Q4 the yen could offset some of the risk.

EUR/GBP. EUR/GBP has turned to the downside, with the pound marginally coming out on top. That said the range over the last month has been painstakingly narrow, and a break out to the downside is not our base case scenario. Overall, we expect the currency to remain close to 0.9000 in the fourth quarter, but we don't have a strong conviction.

EM Currencies. Many emerging market countries face a worsening health crisis and resulting economic risks. Despite the recent bout of US weakness, we fear the economic woes rippling though emerging markets will negatively affect local currencies. Since the middle of march, commodity linked currencies have been hit particularly hard. The Brazilian Peso is down 15.5% versus the USD, and the Russian Rouble has fallen by 12%. US/China trade relations remain on a knife edge, with each country giving up very little ground. It is very difficult to closely calculate how much the currency rate is affecting trade between the two countries. That said, USD/CNY has fallen 5% since the end of May. Looked at in isolation this isn't good for the Chinese economy, but counterbalances are in place to reduce the negative impact.

EUR/USD vs. S&P

Past performance should not be seen as an indication of future performance. Investments may be subject to market fluctuations, and the price and value of investments and the income derived from them can go down as well as up. Your capital may be at risk and you may not get back the amount you invest.

IMPORTANT INFORMATION - PLEASE READ

This document is provided for information purposes only. It does not constitute and under no circumstances should it be considered in whole or in part as an offer, a solicitation, advice, a recommendation or a contract. It is intended to be used by the recipient only and may not be passed on or disclosed to any other persons and/or in any jurisdiction that would render the distribution illegal.

It is the responsibility of any person in possession of this document to inform himself or herself of and to observe all applicable laws and regulations of the relevant jurisdictions. This document is in no way intended to be distributed in or into the United States of America nor directly or indirectly to any U.S. person.

This document is intended to report solely on the services, products, investment strategies and opportunities provided by or identified by the Kleinwort Hambros group ("Kleinwort Hambros Group"). The services, products, investment strategies and opportunities described herein may not be suitable for all clients. Potential clients should consult their financial adviser to assess the suitability of any proposed transaction before taking any action.

Financial Promotion

This document is a Financial Promotion.

Limitation

Information herein is believed to be reliable, but the Kleinwort Hambros Group does not warrant its completeness or accuracy and it should not be relied on or acted upon without further verification. The Kleinwort Hambros Group disclaims any responsibility to update or make any revisions to this document. Opinions, estimates and expressions of judgment are those of the writer and are subject to change without notice. As such, the Kleinwort Hambros Group, Societe Generale and its other subsidiaries shall not be held liable for any consequences, financial or otherwise, following any action taken or not taken in relation to this document and its contents.

Marketing

If you do not wish to receive this document in the future, please let your private banker know or call us on +44 (0) 207 597 3000. Telephone calls may be recorded.

Legal and Regulatory Information

This document is issued by the following companies in the Kleinwort Hambros Group under the brand name Kleinwort Hambros:

United Kingdom

SG Kleinwort Hamros Bank Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. The firm reference number is 119250. The company is incorporated in England and Wales under number 964058 and its registered address is 5th Floor, 8 St James's Square, London SW1Y 4JU.

Channel Islands

SG Kleinwort Hambros Bank (CI) Limited is regulated by the Jersey Financial Services Commission ("JFSC") for banking, investment, money services and fund services business. The company is incorporated in Jersey under number 2693 and its registered address is PO Box 78, SG Hambros House, 18 Esplanade, St Helier, Jersey JE4 8PR.

SG Kleinwort Hambros Bank (CI) Limited - Guernsey Branch is also regulated by the Guernsey Financial Services Commission ("GFSC") for banking, investment and money services business. Its address is PO Box 6, Hambro House, St Julian's Avenue, St Peter Port, Guernsey, GY1 3AE.

The company (including the branch) is also authorised and regulated by the UK Financial Conduct Authority ("FCA") in respect of UK regulated mortgage business and its firm reference number is 310344. This document has not been authorised or reviewed by the JFSC, GFSC or FCA.

Gibraltar

SG Kleinwort Hambros Bank (Gibraltar) Limited is authorised and regulated by the Gibraltar Financial Services Commission for the conduct of banking, investment and insurance mediation business. The company is incorporated in Gibraltar under number 01294 and its registered address is 32 Line Wall Road, Gibraltar.

General

Kleinwort Hambros is part of Societe Generale Private Banking, which is part of the wealth management arm of the Societe Generale Group. Societe Generale is a French bank authorised in France by the Autorité de Contrôle Prudentiel et de Resolution, located at 61, rue Taitbout, 75436 Paris Cedex 09 and under the prudential supervision of the European Central Bank. It is also authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

Further information on the Kleinwort Hambros Group including additional legal and regulatory details can be found at: www.kleinworthambros.com

Any unauthorised use, duplication, redistribution or disclosure in whole or in part is prohibited without the prior consent of Societe Generale. The key symbols, Societe Generale, Societe Generale Private Banking and Kleinwort Hambros are registered trademarks of Societe Generale.

© Copyright the Societe Generale Group 2020. All rights reserved

Sponsorship

Find out why leading brands in the private client industry are partnering with PCD to raise their profile, make connections and drive new business.

Membership

Find out how you can participate in the leading club for international private client advisors and unlock opportunities around the globe.