What past crashes tell us about market timing

![]()

by Andrew Prosser, Investment Manager

What past crashes tell us about market timing

The prospect of losing money can cause substantial apprehension for some investors. Most experienced investors generally have at least one major market crash seared into their memory and the biggest fear therefore tends to be investing just before such an event.

While the likelihood of investing immediately prior to a crash is low, market peaks and troughs are impossible to time. Given this, it is important to understand what a worst-case scenario might look like in terms of market timing and what implications this could have for an investor's longer term returns.

The definition of a 'market crash' is loose and usually associated with a sudden significant fall, but for the purposes of this article we will define it as a decline of 20% or more from a peak (this is the widely accepted definition of a 'bear market'). Under this definition, the US equity market has suffered twelve crashes or bear markets since the Great Depression in 1929, as shown in Figure 1.

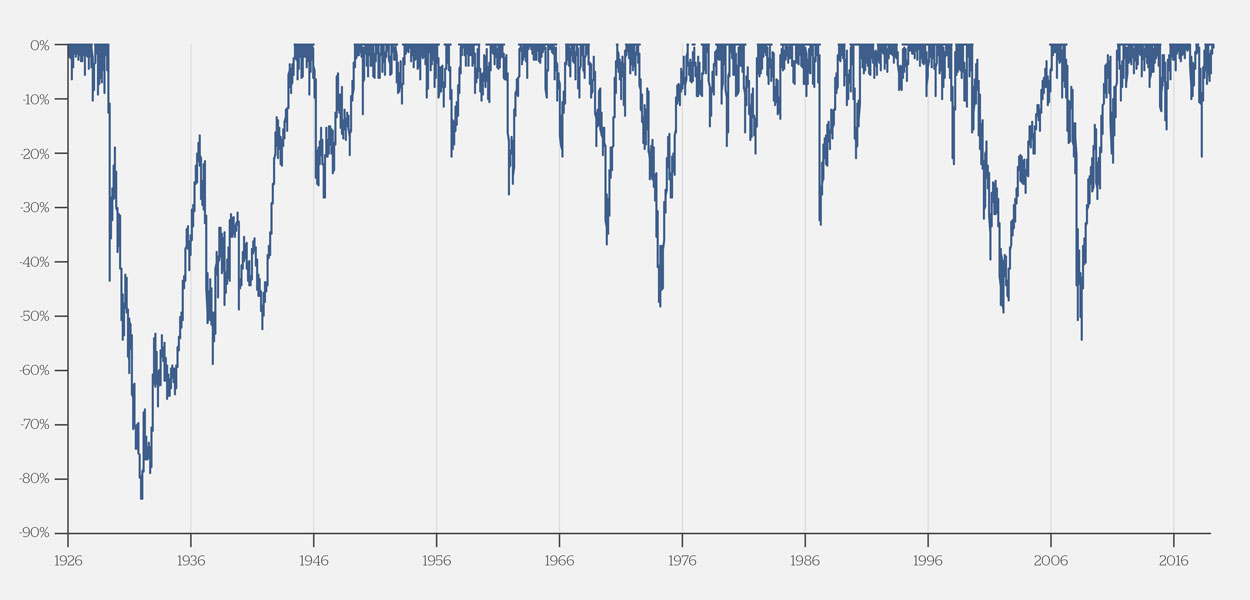

US equity drawdowns

Figure 1: US equity market drawdowns from prior peaks.

Source: Center for Research in Security Prices (CRSP)

Of the twelve US equity market crashes since 1926, an average of about one a decade, four have caused drawdowns of over 40%. These severe bear markets occur about once every 20 years on average. While past performance is not a reliable indicator of future results, history tells us that an investor with a pure equity portfolio should be prepared to experience several drawdowns of varying severity.

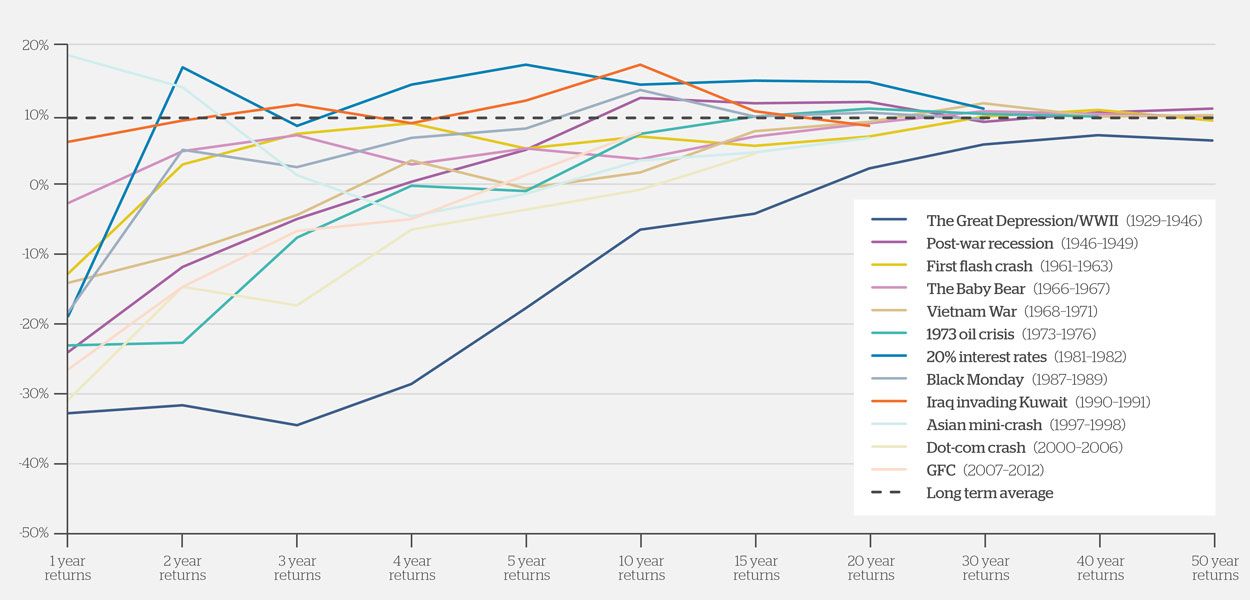

Figure 2 shows the cumulative annualised paper losses, by year, that investors would have suffered if they had invested the day before each crash. The Great Depression was the most devastating, with annualised losses of 35% over the next three years (a compound three-year loss of over 70%). The next worst single-year return was suffered following the Global Financial Crisis almost 80 years later; the three-year loss from the market peak in 2007 was over 50%.Buying at the top: post-investment returns

Figure 2: US equity market post-crash returns, annualised.

Source: Center for Research in Security Prices (CRSP)

Despite these crashes, the US equity market has achieved a respectable average return of around 9% a year since 1926. Longer-term investors who have remained invested following market crashes have seen their returns converge towards this level over time. This demonstrates that market timing becomes less important for investors who have the ability and investment time horizon to buy and hold over the long term.

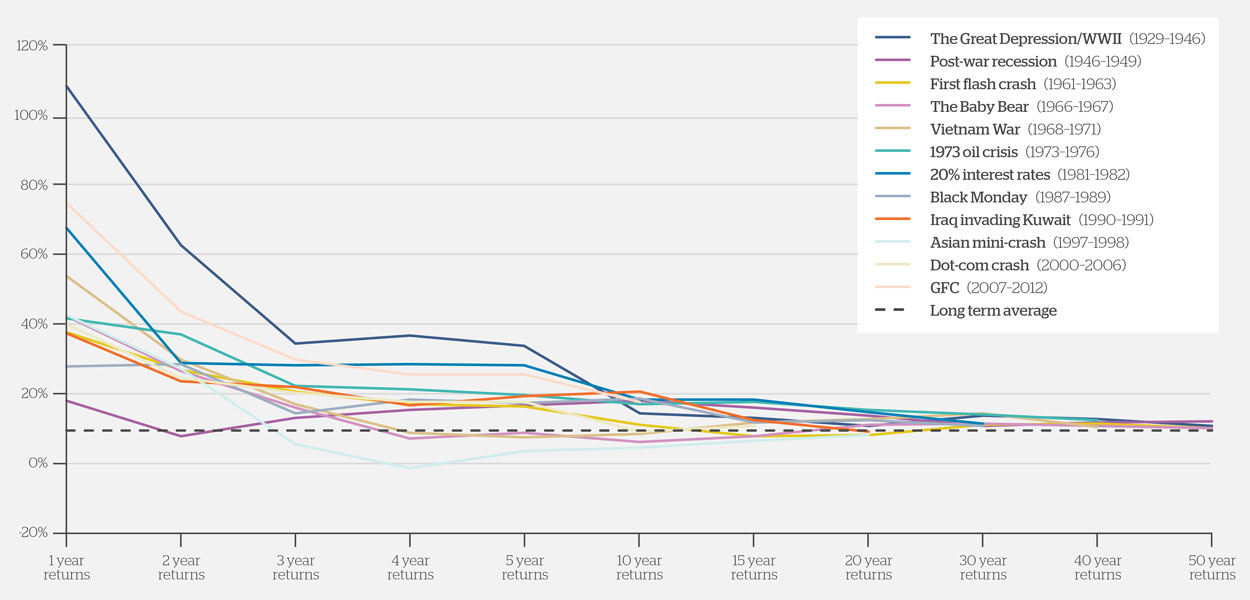

This is also the case for investors who invest at the bottom of the market. For example, an investment made at the bottom that followed the Great Depression would have generated a one-year return of over 100% and an annualised five-year return of 34%. Nevertheless, these fantastic short-term returns would still have converged towards the 9% average over the longer term, just as they did for those who invest at the top of the market Figure 3.

Buying at the bottom: post-investment returns

Figure 3: US equity market post-market low returns, annualised.

Source: Center for Research in Security Prices (CRSP)

To quantify this convergence, Figure 4 shows the difference between the worst and best possible investment timing for each of the five market crashes for which we have subsequent 50-year data.

30-year annualised returns by market crash

Figure 4: This dispersion between pre- and post-crash 30-year returns, annualised.

Source: Center for Research in Security Prices (CRSP)

The difference between the best and worst timing for the Great Depression is a clear outlier, given how extreme the drawdown was relative to any other drawdown in history. No other market drop has come close to that of the 1920s; the other markets crashes were more similar in magnitude, with drawdowns between 21% and 48%. Excluding the Great Depression, all other scenarios have relatively small differences in annualised returns, given that they have been engineered to be as large as possible.

The compounded effect of the differences between the absolute worst and the absolute best timing would still have a significant effect on terminal wealth, but this is a most extreme case; most people won't be investing right at the top or bottom of the market. In practice, other factors will have a larger impact on most investors' wealth after 30 years. These include life events (inheritances, divorces, house decisions), changes in earnings, changes in spending, and changes in investing behaviour. Additionally, we believe it prudent to drip feed funds into the stock market over a few months to reduce these risks.

Conclusion

It is obvious that someone investing at the nadir of a severe downturn will experience stronger returns than someone who invests at a peak, even after a long period of time. However, the data demonstrates that time significantly reduces the impact of either event.

As investors' time horizon increases, the point at the initial investment was made becomes less relevant and the length of time over which they have invested more important. This is because returns become driven by the long-term effects of compounding, rather than the market's initial value.

It is broadly accepted that higher reward is accompanied by higher risk. As such, long-term equity investors should be prepared to experience some drawdowns during their investing lifetime. Although this prospect can be daunting, getting cash invested as relatively swiftly and maximising time spent in the market is preferable to keeping cash on the sidelines and trying to pick market peaks or troughs, which is impossible. Equally, the proportion of an investor's portfolio that should be exposed to equity markets should be to a large extent determined by an investors' time horizon. Stock markets are no place for the short-term speculator but are a very fruitful environment for the longer term patient investor.

It can be difficult to stay invested when there is a lot of panic in the market, but it is important to maintain a long-term perspective and remember the powerful effect of compounding on returns. Only those with the inclination to stay invested during these times should be investing in a high-risk asset class such as equities. Those who follow the herd of sellers in a time of heightened fear turn paper losses into permanent ones. As the data above demonstrates, those who are patient are rewarded. The most successful investors see opportunities when others are fearful and add to their equity positions during periods of market turmoil.

As every article about buy-and-hold investing must include at least one famous investing maxim, it seems appropriate to end with one of the most famous. We've seen that it doesn't matter whether you're the world's best investor, or the world's worst; time in the market really does beat timing the market.

Contact:

www.brooksmacdonald.comSponsorship

Find out why leading brands in the private client industry are partnering with PCD to raise their profile, make connections and drive new business.

Membership

Find out how you can participate in the leading club for international private client advisors and unlock opportunities around the globe.