Why Cash Isnt Always King When It Comes to Acquiring a Private Jet

![]()

![]()

By Iain Houseman at Elit'Avia and Gary Crichlow at Arc & Co.

To download the PDF version of this article click here.

Arc & Co. in conversation with Elit'Avia

The world of financing can seem a complex arena to navigate to get the best deal and, as such, the majority of private aircraft transactions are in cash. There are a number of reasons for this, including that aviation finance is often seen as too much of a hassle, too expensive, restrictive, invasive, complicated, not transparent or all of the above. It's true that putting a finance deal together is a complex undertaking. But there is a key benefit that makes finance worth considering:

Your cash isn't tied up in a depreciating asset

Having such a large capital investment in an asset that depreciates in value over time makes financing an attractive option. Linking financing to the different tax regulations and exemptions makes it an even more approachable option when maximising the value of retaining capital for investment in other areas.

Of course, there are always exceptions to this depreciating-asset rule: sometimes the market dynamics can be such that specific aircraft types and models become particularly sought after and appreciate in value as a result (e.g. the Gulfstream G550). But these are exceptions, with limited durability of demand and the dynamics are volatile: value bumps are often unpredictable, sudden and short-lived. Speculative buyers looking to buy low and sell high need to know what they're doing, have a high risk tolerance and be willing to go through the complexities of the buying and selling process at a moment's notice in order to capitalise. Whether you're buying the aircraft for use or speculation (or both), accessing finance preserves your cash - allowing you to invest it elsewhere.

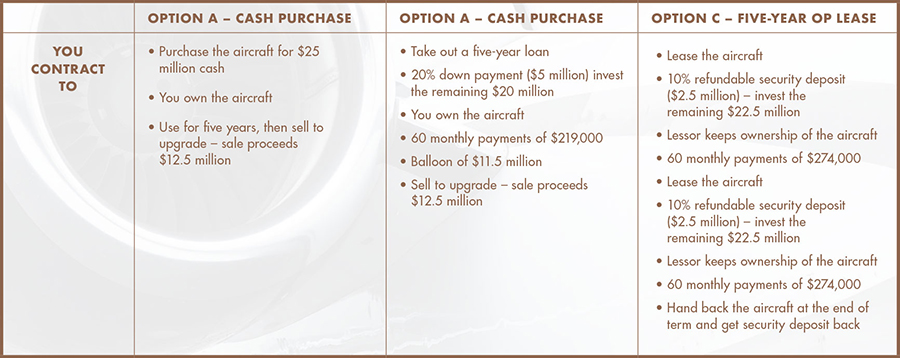

To illustrate the benefits of financing a private jet versus paying cash, we've put together an example using a $25 million jet acquisition. The options (simplified for illustrative purposes) to the client are:

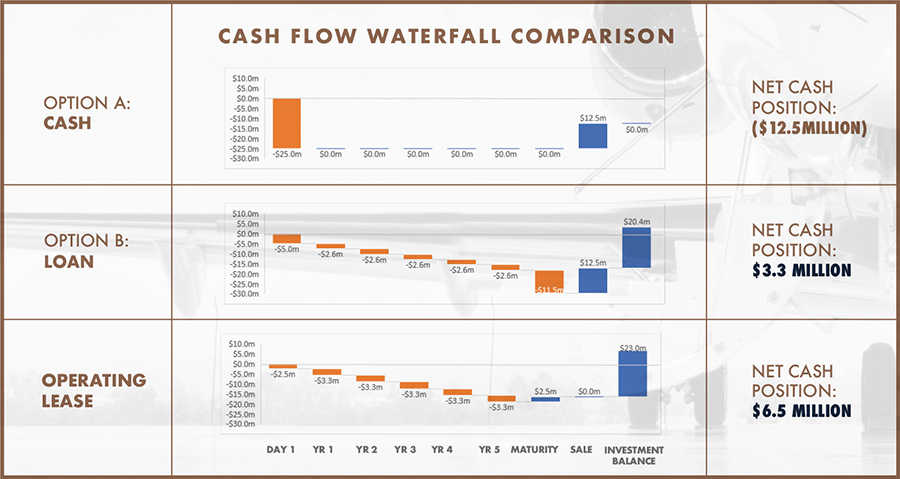

The cash flow waterfall comparison below shows that, even with the most conservative investment scenario where the remaining cash is invested in US Treasury Bills, the difference in net position at maturity between the outright cash purchase and the finance options is stark: On a $25 million aircraft transaction our difference in net cash is as high as $19 million. It's all down to the ability to put your money into investments that earn a return for you - whether that's in your business or elsewhere - rather than in a depreciating asset.

The cash flow management benefits become even clearer when the costs of operating and managing the aircraft - which will apply whether financed or paid for in cash - are taken into account:

Adding in the cost of ownership - It's not just the sticker price

When looking to acquire an aircraft, it often comes as a surprise that the economics of managing it can be just as significant as the initial acquisition cost. The timing of large scheduled maintenance events also needs to be considered and a thorough review of upcoming events and mandatory upgrades should be undertaken prior to taking delivery.

For example, a 2010-built Global XRS will have a 10 year inspection due in 2020, an event that could run anywhere between $1- 4 million. The installation of ADS-B capable avionics will be mandatory in the US from 1 January 2020 and in Europe shortly thereafter. Non-compliant aircraft will simply not be allowed to fly without severe restrictions.

Exiting the deal at maturity

Disposing of (selling on) your aircraft is a complex undertaking and decisions made at inception and during the term can come back to haunt you. In the scenario we crafted earlier, the client wants to upgrade after five years. If bought outright or financed via a loan or finance lease-type product, the risk and hassle of turning the aircraft metal back into cash is theirs. When making the decision, it's important to have a clear understanding of the factors that add complexity to disposing of an aircraft, especially from a technical perspective.

For example:

- Does the aircraft have all of its technical records from manufacture and are they in English?

- Does it have any damage history?

- Does it meet current and upcoming regulatory requirements from the perspective of most buyers?

- Does it have major maintenance events pending?

- Is it enrolled in an hourly maintenance support programme?

- Does the floor plan and specification align with what most buyers are looking for?

- Where will it operate, who will operate it, what registry will it be on and will it be private or commercial?

The key point here is making a sure assessment of the aircraft so that any challenges or issues have been resolved before you come to dispose of it, as this can involve numerous stakeholders' perspectives on residual and actual value. And if there weren't challenges when you acquired the aircraft, then you will ideally have invested in high-quality maintenance, operation and oversight during your tenure to keep the aircraft in top condition.

Future market prospects

Beyond this, it's important that if you elect to take on the risk and reward of aircraft sale, you are realistic about your aircraft's market prospects. Generally speaking, holding out in an aircraft sale for pricing to go up is a very risky strategy: aircraft are generally depreciating assets and while they sit on the market they still require maintenance, hangarage and ongoing care, all of which will eat into the amount of cash that will be realised from a sale. In an operating lease, all those risks are shouldered by the financier. For clients who do not place an intrinsic value on ownership (noting that the financier retains the title in an operating lease) and prefer the peace of mind that comes from being able to hand back the aircraft no matter what it's worth, operating leasing can be a very attractive financing option.

However, as the lessee, you still have an obligation to return the aircraft to the lessor in a certain condition as stipulated in the lease contract, in order to receive your security deposit (and avoid being on the hook for additional charges related to non-compliance). This is where retaining expert technical advice and management throughout your usage of the aircraft can add significant value when it comes to the back end: not only can a competent technical manager find ways to ensure your ongoing operation and maintenance costs are kept manageable, but they can also keep an eye on the aircraft's overall condition and maintain the paperwork as it progresses through the financing term. They can identify and mitigate potential challenges and then address any challenges - either to the aircraft's disposal value (if it's a loan) or the aircraft's hand-back to the lessor (if it's a lease) - well in advance, before they grow into major issues at maturity.

Assembling a team you can trust

The aviation finance landscape is constantly evolving, with new opportunities and different ways to structure a deal; one that will allow you to put your capital to work in the most efficient way possible, rather than tying it up in an asset that loses its value. In order to get the best overall deal, it's important to understand that finance is just one piece of the puzzle - the aircraft also needs to be managed. Like the two halves of your aircraft's wing, the finance and the management considerations work best when they've evaluated as a whole: to capitalise on opportunities, negotiate away risks where you can and manage them effectively where you can't. The best time to do this is always before the ink is dry on a contract; investing in competent expertise will enable you to take advantage of the best strategies to mitigate your exposure. Expert input (or lack thereof) will have a significant bearing on your ability to negotiate a favourable transaction.

Contacts

Gary Crichlow

Tel: +44(0)7795 128041

Email: gary@arcandco.com

www.arcandco.com

Iain Houseman

Tel: +44 (0) 7854 662 961

Email: iain.houseman@elitavia.com

www.elitavia.com

Sponsorship

Find out why leading brands in the private client industry are partnering with PCD to raise their profile, make connections and drive new business.

Membership

Find out how you can participate in the leading club for international private client advisors and unlock opportunities around the globe.